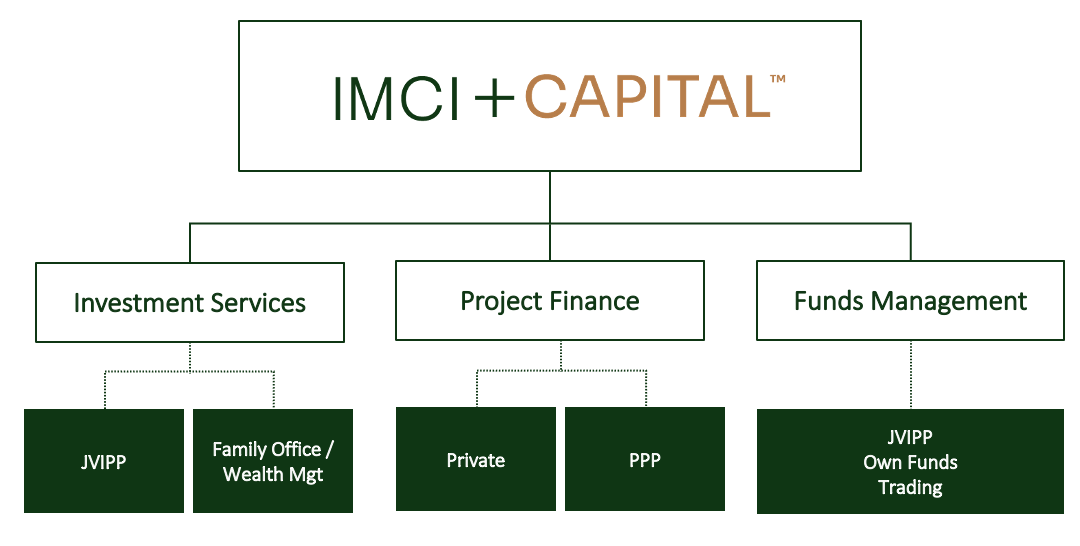

IMCI+ Capital Services (Investment Services, Investment Fund, Project Finance)

Our Capital Services is led by three strategic fields

1. Investment Services

We are offering “boutique” Investment Services to HNVI, Family Offices, Institutional investors, in aspects of different tailored programs, with a combination of equity, fixed rates, and leverage ROI.

2. Project Finance

Acting as an underwriter and fiduciary of a total of 70 banks and PE Investors, we can provide alternative funding solutions and related advisory.

3. Funds Management and Trading

We can provide a fully regulated investment Fund structure in partnership through our structure. Further, we are linked to serious top trading desks, offering attractive programs.

For more information visit us on: www.imci-capital.ch